One of my friends told me that “he was going to Uber over” to my place. It just struck me then about how tech brands are fast becoming verbs like “Googling” and “Airbnbing”. The success of such brands has inspired disruptions across many traditional business models. Freight Brokerage is one such industry that is on the verge of digital disruption. In this blog, I share how AI/ML led innovation will be an integral and game-changing part of this journey.

Who is a Freight Broker?

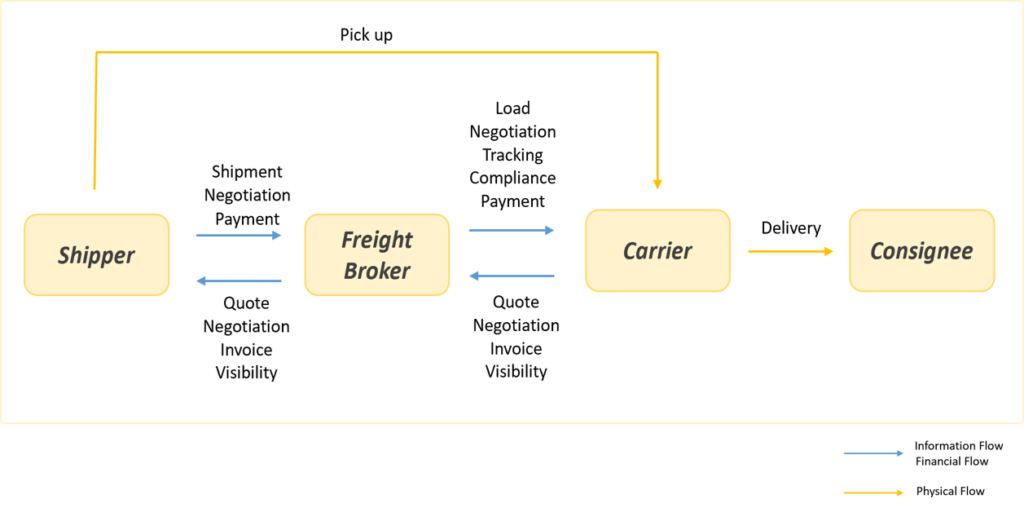

A freight broker or a freight forwarder is a zero-asset intermediary who helps shippers move commodities by connecting with a large network of carriers. Freight brokers, via freight brokerage, may also provide operations support and in some cases provide managed transportation services. Picture 1 shows the information flow, financial flow, physical flow, and players involved in the value chain.

Picture 1

Industry Ripe for “Uberization”

The Freight Brokerage industry for truckloads is a $700 Bn industry in the US with a competitive margin of about 14%. Some of the brokers in this space also provide service via other modes such as Intermodal (rail), Less than Truck Loads (LTL), Parcel, International (Ocean and Air). The value chain is quite complex with diverse and fragmented players across shippers, brokers, and carriers. In fact, the top 20 of truckload broker companies make less than 4% of overall industry revenue. Most transactions happen via phone calls between shippers/brokers or brokers/carriers. Additionally, a disintegrated value chain makes it very difficult to manage the information flow for execution and visibility which makes the process very slow.

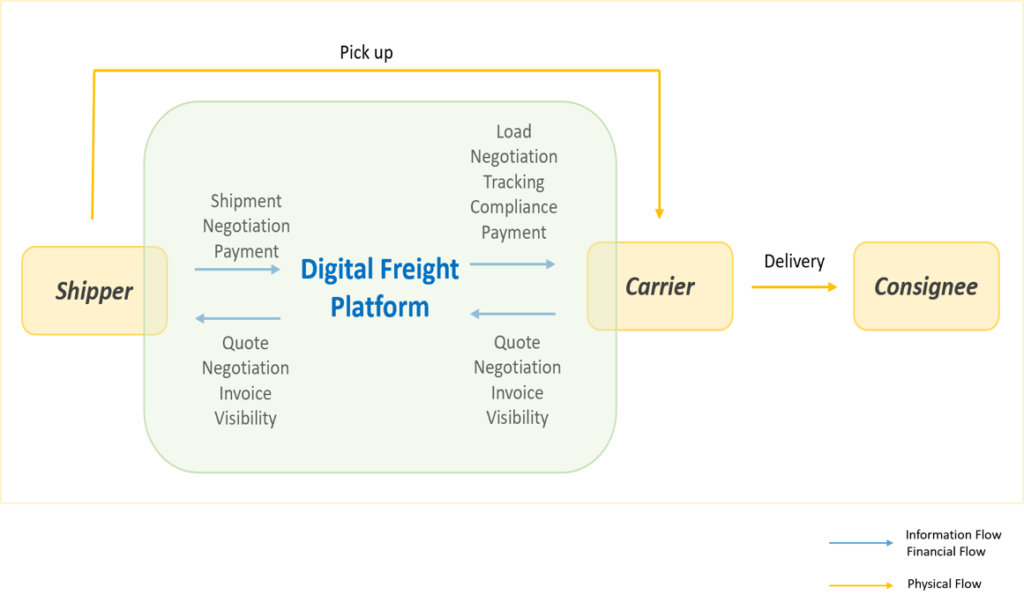

Intelligent automation via a Digital Freight Platform will bring in efficiency, speed, and reduce cost across the value chain. Load boards such as DAT and Truckstop were early entrants in this space and they attempted to automate but their roles were reduced to that of a marketplace – which became another tool in the kitty of brokers/carriers. Over the last few years, tech companies such as Uber Freight, Convoy, Flexport have started making small dents in the market with the goal of removing the middleman (broker) in the value chain (refer to picture 2) by building an app-based Digital Freight Platform. At the same time, the large traditional brokerage firms have also been trying to catch up with tech companies, or else they face the risk of being made redundant.

Picture 2

AI/ML will be the game-changer for Digital Freight Platforms

A senior executive from a third-party logistics firm I interacted with mentioned ‘a minute in the freight business is like a lifetime’ considering competition and carrier capacity challenges. It is key to secure shipment from a shipper quickly and negotiate/get capacity from carriers. Brokerage firms are always trying to get to the “North Star” goal of “Finding the RIGHT carrier for the RIGHT buy price at the RIGHT time and charge the RIGHT price to shippers”.

AI/ML can help brokerage firms reach the “North Star” by enabling the following capabilities in their Digital Freight Platforms

Pricing Right – Agents are tasked during their day-to-day transactions to figure out the price to pay the carrier and the margin to keep for shipper pricing. An agent I worked with had about 10 LCD screens in his office with multiple data points that he used to figure out the pricing for the day. Spot market pricing is very dynamic depending on several factors such as:

- Seasonality of the lane – For example, northwest outbound prices will be high during Christmas season or produce season (spring to early summer) prices will be higher from Southern states

- Market supply and demand balance (equipment availability to loads requested)

- Weather – hurricanes or snow blizzards

- Time of the day for pick up (later in the day increases the prices)

- Day of the week

- Length of the haul (drivers have been preferring shorter haul in the recent years)

- Lead time between the booking and pick up (last minute or urgent pick up leads to increased prices)

- Equipment Type – certain equipment such as flatbeds or tankers are of limited inventory in the market, leading to premium prices

- Special requirements – Hazmat suits

Agents will not be able to effectively process such multiple factors to come up with a spot price quickly. Machine Learning algorithms can help here by processing a host of internal and external data points to predict the spot market prices accurately. The models could be easily extended to predict the right price for contracts as well. On the customer pricing side, agents typically use past data or go with intuition for determining margin percentages. An ML algorithm can be of help to remove the subjectivity and recommend a price that the customer will be willing to pay.

Knowing the carriers – The truck carrier network is very diverse with about 1.2 million companies in the US out of which 90% operate six or fewer trucks. Brokers vet the carriers to add to their certified network but the capacity is not dedicated. Even the contracts are soft binding which carriers may break at times for better rates in spot markets. Effective engagement and securing the capacity from carriers will involve having the following:

- Carrier 360 – One of the challenges of building a carrier 360 (essentially a complete view of the carriers) is the availability of clean and structured data about them. Companies can use the internal and external data available (load board searches/postings) to build a carrier profile using algorithms. This is to infer preferences such as lanes, available capacity, length of haul, weekday, expected rates, home base. This will help not only to match carriers for loads but also in pushing personalized loads (similar to campaigns on the customer side) to carriers.

- Reducing empty miles (Loads to Tours) – It is estimated that typically 20%-30% are empty miles (empty trucks backhaul after delivering a load to destination) in the trucking industry. This has been a major issue resulting in environmental impacts apart from increasing the cost for shippers/carriers. Machine Learning can help identify the round trips or tours instead of single loads matching with the carrier’s preference thus reducing the overall cost – a win-win for all players in the value chain.

Bots for bids management – Loads are sent out to carriers for bids and evaluated based on multiple criteria such as service level apart from cost. Intelligent bots can drive the bid process making offers/counter offers with carriers

Voice-enabled guidance – The average age of a truck driver in the US is 55 years. It is very important that the platform is user friendly so that adoption will be high. NLP based solutions can enable voice assistance while finding a load or completing a transaction

Facility Insights – Carriers can leave feedback on pick-up/drop-off facilities which can be mined by NLP algorithms to provide insights to shippers on facility insights. The insights can be used by shippers to reduce cost such as detention charges (reducing time to load/unload) or attract carriers by incentivizing with better facilities (bathroom access, parking, refreshments)

Compliance – Brokers need to ensure carriers are compliant in terms of insurance, hours of service regulations, driving safety, vehicle maintenance, and Hazmat requirements. Risk models can help rate the carrier’s compliance to avoid potential legal issues

Conclusion

Digital-first challengers such as Uber Freight/Convoy have shown some early signs of success. One of the key challenges for tech companies is in establishing trust and relationships with shippers/carriers in the B2B world. Tech companies have forced the legacy players to rethink technology investments. The legacy players have an advantage of years of relationships and credibility in the market. They have a great opportunity to leverage AI/ML to bring efficiency, improve shippers/carrier experience, increase speed, and reduce overall cost and remain relevant in the logistics value chain.