Why eCommerce for CPG?

The clear, permanent shift towards digitally driven consumption is turning up the heat on retail, but for CPG manufacturers it represents an opportunity – at least till now, should we say? Ecommerce platforms are in fact fast becoming the main growth area for CPG companies, across geographies. (For some interesting statistics, we recommend reading this insightful article from Nielsen).

To win, CPG manufacturers adopt one of the following eCommerce models:

1. Partnerships with pure-play online retailers, of which Amazon has been a prime example (pun!?). While it is predominantly online, it is no more pure-play online only.

2. Online channels of traditional brick-and-mortar players (the walmart.coms of the world)

3. Direct-to-Consumer platforms with a content + commerce angle. Till now, this model is used more for content sharing with consumers than commerce – less than 1% sales across most categories, but this could change as CPG supply chains adapt.

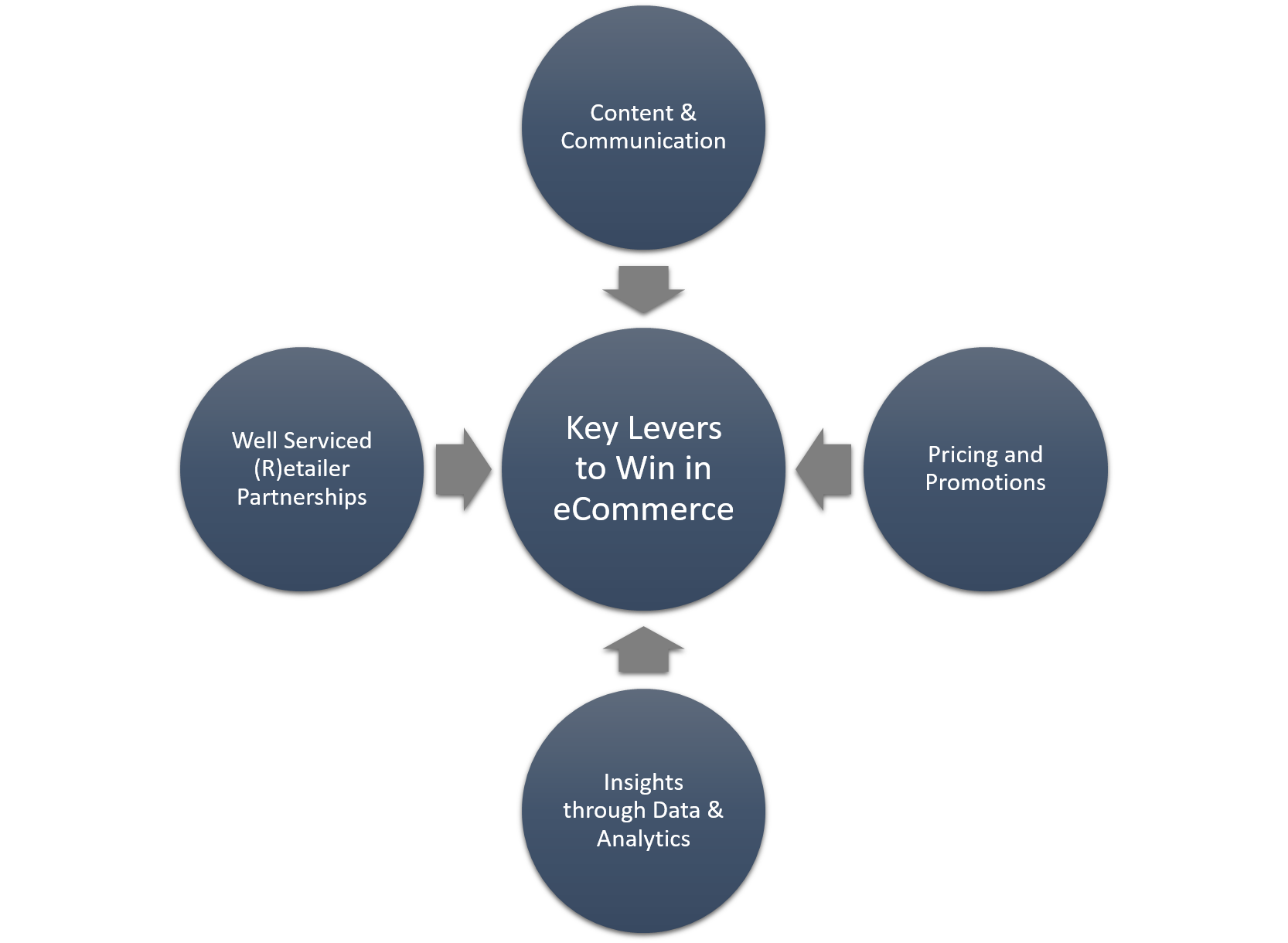

Across all three of the above, especially on the commerce part, levers to win (as articulated in the pictorial below) are not very different from what worked in the pure offline world. Given our experience is mostly around delivering insights through data & analytics, the rest of this article is focused on that aspect.

Importance of eCommerce Data for CPG Manufacturers

In the offline world, CPG manufacturers get a broader market picture (volume/value sales, brand shares etc.) relying on data from syndicated providers (largely Nielsen & IRI) than having to pipe in PoS data* from every major retailer. We often hear in discussions that for the ecommerce side of the market, syndicated data sources are yet to fully mature to provide a reliable market view covering all relevant ecommerce players across the range of key categories. Given this context, an absence of any proactive data initiative by a CPG manufacturer will make it difficult to understand its brand/category growth drivers at the right level of granularity and use that to improve share. Striking the right data sharing partnerships with relevant ecommerce partners to get sales data in place and subsequently leveraging that for a range of insights-driven in-channel / cross-channel decisions is a high priority area for many top CPG companies.

[* Of course, CPGs leverage PoS as well, for account specific deep-dive insights and service level improvements, another trend that’s accelerated from around 2010 with the advent of affordable solutions to store and analyze data]

In an ideal state, marketing data – across traditional as well digital marketing channels, are brought in to comprehensively cover the ‘stimuli’ side, while sales data – shipments as well as data on consumption through ecommerce, PoS, syndicated, are brought in for a holistic picture of the ‘response’. Then there are others such as panel data, shopper cards etc. However, given such a large scope could take many years to materialize, CPGs often divide and conquer. When it comes to bringing large quantities of data in-house, or on to a platform managed by a partner on behalf of the CPG manufacturer, the scope of data that is brought in as well as the underlying technology infrastructure scales asymmetrically across functional areas, depending on:

1. Cost and ease of availability of data,

2. Ease of bringing the data on to internal platforms,

3. Utility of such data in relevant areas of decision making, and

4. Business value potential

These together drive the allocation of funds from the functions. In such a model, we have often seen acquiring data from ecommerce partners getting a higher priority over bringing highly granular data around digital consumer journeys which could be understood to a reasonable extent via agency provided solutions rather than bringing all marketing data in, on priority.

[Please note this is more of a sequencing decision than a substitute forever. Some of the respected global CPGs we work with already have a good hold on the marketing side of the data and are now moving to conquer the eCommerce side; but if you are just about starting on the data journey, the sequencing would be different, in our point of view. If not immediately, very soon, bringing comprehensive digital consumer journey data will become highly relevant to bring in rather than only rely on external inputs – if a CPG manufacturer’s aspiration is to be a category leader driven by differentiated insights. That’s another topic for a different day: back to ecommerce now]

Data Management

When it comes to building a solid data foundation for ecommerce, it is essential for CPGs to have the following covered:

Scope of data: Building out the overall strategy for data management requires scoping out data needed to align with business objective and availability. Data acquired from partner retailer includes ecommerce Point of Sales data, content & online behavior, and search terms. Internal firm data could be integrated with aggregated sales to provide a holistic picture. It could include promotion calendar, shipments specific to ecommerce, priority search terms, pricing strategy (ceiling/floor) etc.

Building robust data pipeline & quality control: It is crucial to build a scalable data pipeline. This includes collecting data from different sources, storing the data – including in-memory processing & storage, in an optimal way so that the data mining is effective and less time-consuming.

Data cataloging: Creating standardized metadata and ability to look up with master data is another critical element to ensure roll-up from individual components of data from various sources/geographies.

Governance: Establishing processes for data visibility (to users), data lifecycle management, aligned data aggregation rules vs arbitrary, and data quality monitoring to ensure effective data management

Covering these will ensure trusted & timely delivery of data to users. In summary, it is critical for CPG manufacturers to build expertise in eCommerce data management to ensure adequate data assets are available for the downstream analytics – whether such analyses are heavyweight predictive analytics by data scientists or lightweight DIY analyses by business users.

eCommerce Analytics

After* successfully building the data foundation, the next step is to arm the business with precise insights that drive differentiated execution. Yes, but in which areas? As outlined above, the other three critical pieces to win in eCommerce are Content& Communications, (R)etailer Partnerships, and Pricing & Promotions.

[*While the mention of analytics ‘after’ data may indicate the progress from data to analytics is very linear, most analytic themes are often tested for value using snippets of data even as the data foundation is taking shape and are quickly scaled across customer teams when a critical mass of data is in place.]

Analytics Around Content

Analytics is useful to optimize content and syndicate it across e-retailers. Causation analysis of product sales with product information is critical to not only optimize the content but also adapt to ever-changing needs for digital engagement. With deeper data from partners, the impact of product imagery and messaging on ecommerce sales is doable too, but not that prevalent as yet.

Partner-specific Analytics

A long tail of products is commonly observed in ecommerce where shelf space is unlimited. One of the struggles for CPG manufacturers is to understand their most profitable products and optimize its assortment for adequate coverage of consumer segments and price points for each retail partner.

If some form of consumer profile data (even aggregated) is available from the partner, that’s of great help. Even if not, classic price-ladders and blended data analyses with online purchase behavior from consumer panel providing a view of the preferences help make a start.

Another big area here is around service levels on shipments against ecommerce orders – which is as critical for ecommerce as in the off-line world. A quote seen in a recent article from BCG best summarizes this – “Stockouts, bad enough in traditional retail, can be deadly to an online seller”. It couldn’t have been said better. We recommend reading it for a detailed treatment of how CPG supply chains are adapting in the context of the three different ecommerce models.

Price & Promotions

Effective promotions – the online equivalent of traditional trade promotions, however it is named and accounted for, is highly critical in ecommerce as well for multiple reasons. It’s often a top spend item for CPG brands. In addition, pricing and promotions are highly visible for shoppers and comparison engines alike. Hence, it pays (quite literally!) to understand ROI through detailed impact attribution of promotional activity – what worked, where, when and what’s the true incrementality vs share shift. With good quality ecommerce partner data, this is an area that can be addressed with sufficient confidence. Even if only marketing spends are available and not detailed consumer journeys, it is still possible to get a good picture of promotional impact.

Consumer Digital Journey

This, of course, is not about ecommerce alone, but an integrated view of data from both ecommerce and marketing. Depending on the depth of the data, it is quite possible to build the equivalent of a Market/Media Mix Analysis specifically focused on consumption through the ecommerce channel; or get a complete view of the digital consumer journey replete with attribution analysis.

Of course, for such deeper analysis, data on offline + online media consumption as well as category consumption is required, which comes from specialized players, at additional cost. This approach helps get a comprehensive omnichannel consumption view of the consumer than having to draw artificial offline/online boundaries. Given that, such intensive data acquisition decisions are usually not taken alone by ecommerce teams, but with a total consumption perspective in conjunction with brand marketing and consumer market insights (CMI) teams.

Conclusion

For a USD 10 billion-sized CPG business with a 1.5% annual growth, if most of that growth in next few years is expected to come from ecommerce, that means a USD 500 million business opportunity over the course of 3-4 years. No wonder then that this space attracts much of leadership attention. As opposed to a general approach of evaluating ROI on individual initiatives, when it comes to eCommerce, looking at this bigger picture has helped many in the industry to quickly move from planning to execution mode.